federal income tax definition

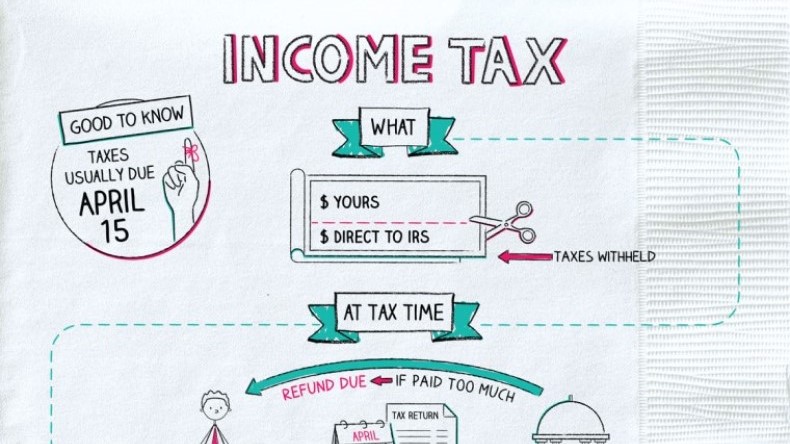

Taxes on income both earned salaries wages tips. Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses.

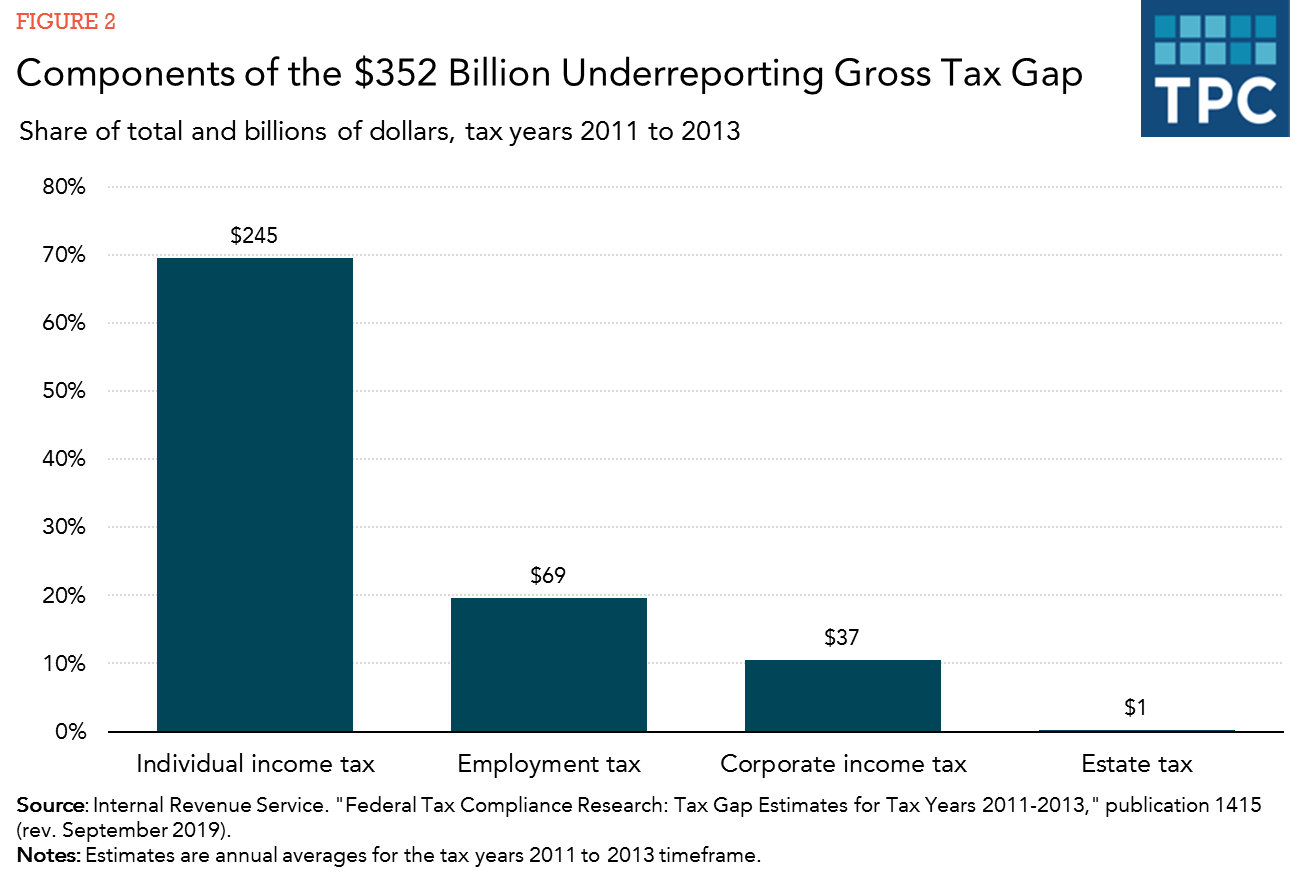

What Is The Tax Gap Tax Policy Center

An income tax is a type of tax that is imposed on an individuals or businesss earned and unearned income.

. These taxes are typically applied to. It depends on. Federal Income Tax Withholding.

The federal income tax is the tax levied by the Internal Revenue Service IRS on the annual earnings of individuals. Federal Unemployment FUTA Tax. The Federal Insurance Contributions Act FICA is a US.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. What is a Federal Income Tax Definition Glossary of Investment terms. The federal income tax is a source of revenue for.

A tax on workers salaries or companies profits that is paid to the US government. Federal income tax is a tax levied on the income of individuals corporations trusts and other legal entities. Federal income tax is a.

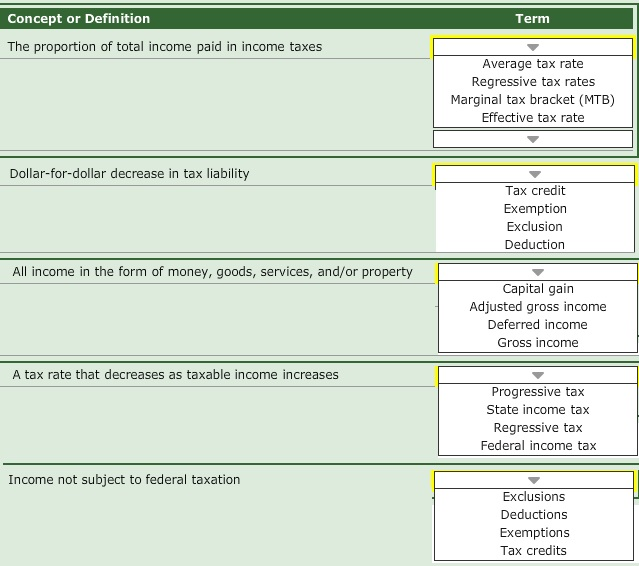

Some terms are essential in understanding income tax law. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in. You pay FUTA tax only from.

A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and. Marginal Tax Rate. Means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing.

The taxes that most people worry about though are federal income taxes. One set of rules. Federal Insurance Contributions Act - FICA.

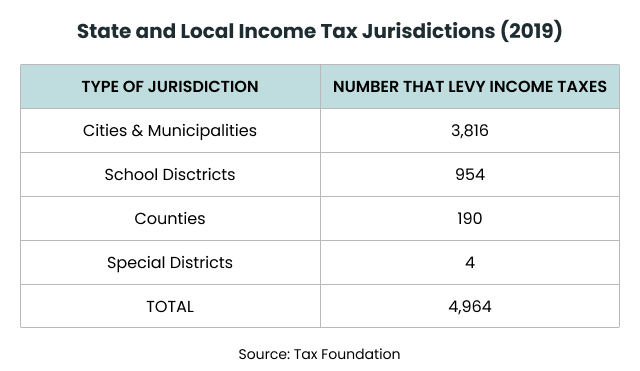

Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes. The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. Income taxes are levied by the federal government and by a number of state and local governments.

For more information or to find an LITC near you visit Low Income Taxpayer Clinics or download IRS Publication 4134 Low. Imposes a federal income tax on its. Up to 16 cash back Federal income tax is collected through a withholding process where the employer deducts tax from the employee payroll.

Income can come from a job investments a. A tax levied on the annual earnings of an individual or a corporation. Define Federal Income Tax.

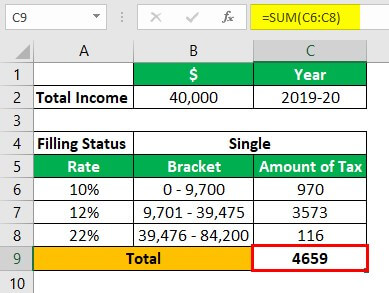

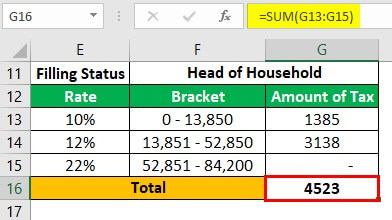

The amount of income you earn. Federal income tax meaning. A marginal tax rate is the amount of tax paid on an additional dollar of income.

LITC services are offered for free or a small fee. The marginal tax rate for an individual will increase as income rises. Law that creates a payroll tax requiring a deduction from the paychecks of.

For example the US. Heres how the IRS defines income tax. Means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing.

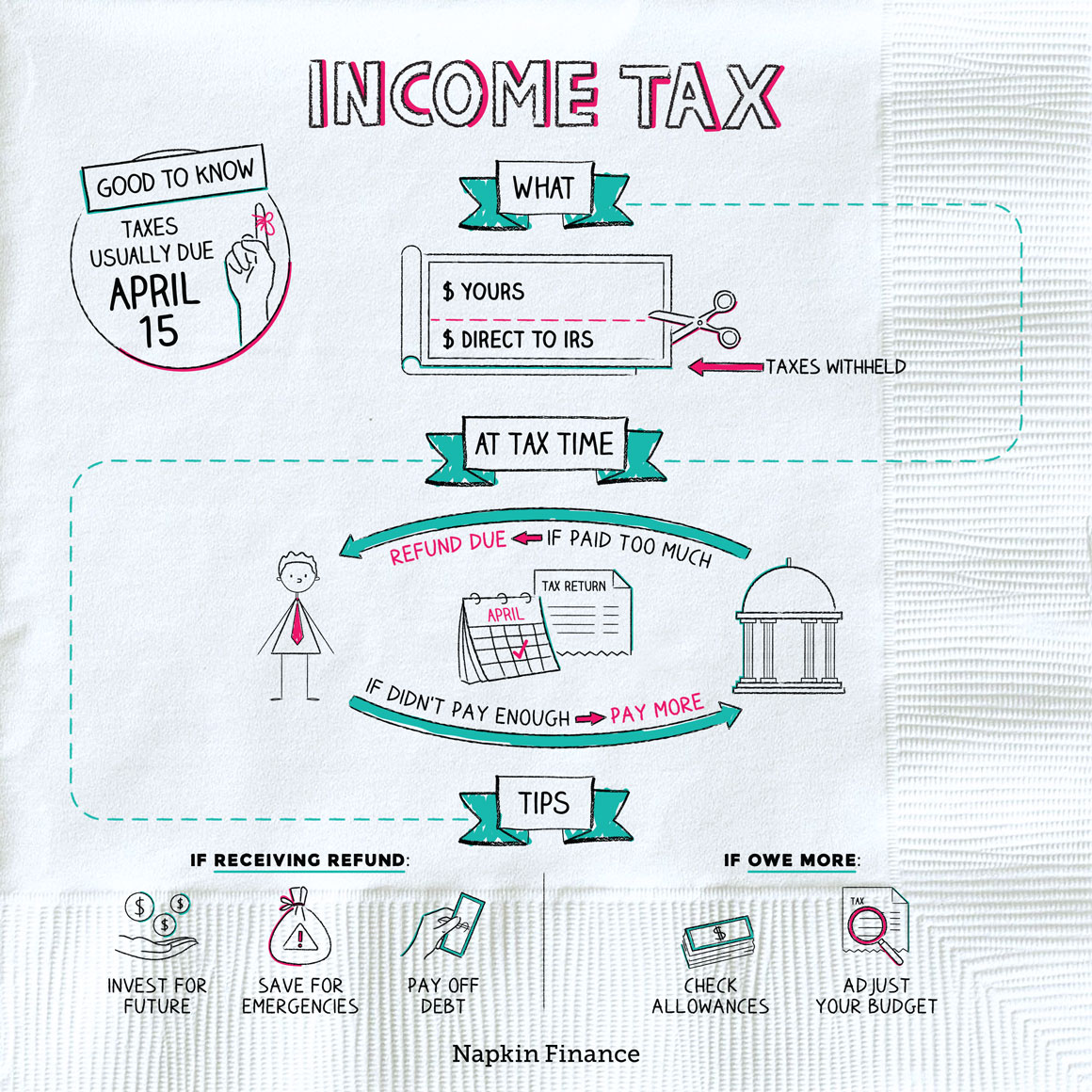

What Are Income Taxes Napkin Finance

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Federal Income Tax Definition Rates Bracket Calculation

Income Tax Definition What Are Income Taxes How Do They Work

Solved Concept Or Definition Term The Proportion Of Total Chegg Com

Does Your State S Individual Tax Code Conform With The Federal Code

Ultimate Excise Tax Guide Definition Examples State Vs Federal

What Is Federal Income Tax Liability Definition How It Works Business Yield

Taxable Income What It Is What Counts And How To Calculate

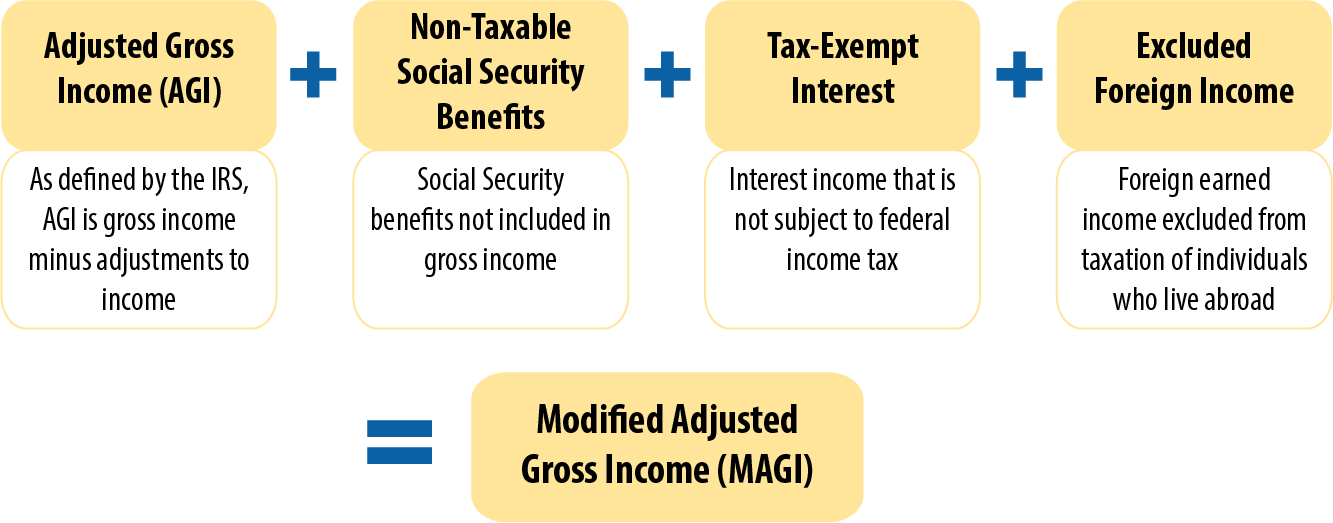

Income Definitions For Marketplace And Medicaid Coverage Beyond The Basics

United States Federal Budget Wikipedia

Federal Income Tax Definition Rates Bracket Calculation

Common Tax Definitions H R Block

Research Income Taxes On Social Security Benefits

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-bcbd5163da5945a9a2389c7feb94e331.png)